Invoicing

Online invoicing? It's a breeze

Get paid faster with PayPal

Create invoices and give your customers secure way to pay. Activate PayPal and accept credit and debit card payments — your customers don’t even need a PayPal account.

Keep on top of your finances

Your dashboard gives you a quick and confident overview of all your invoices, what's due, what's overdue and what's been paid

Get invoicing done quicker

Set up your invoice template, save customer details and send invoices to customers quickly and easily

Smart accounting uses your invoices for tax reporting

You can focus on the important stuff with our app as it pulls your transactions, automatically applies tax codes, prepares tax records, and makes sure you're fully tax compliant

Get things done with Oflode

Integrations

Connect your marketplaces and bank accounts to see real-time sales, returns, and fees and make smarter business decisions

Accounting

Your dedicated accountant will know your business inside out, helping you manage your taxes, GST reports and more

E-commerce

Automate bookkeeping from all your sales platforms and lean on your accounting expert who understands e-commerce business

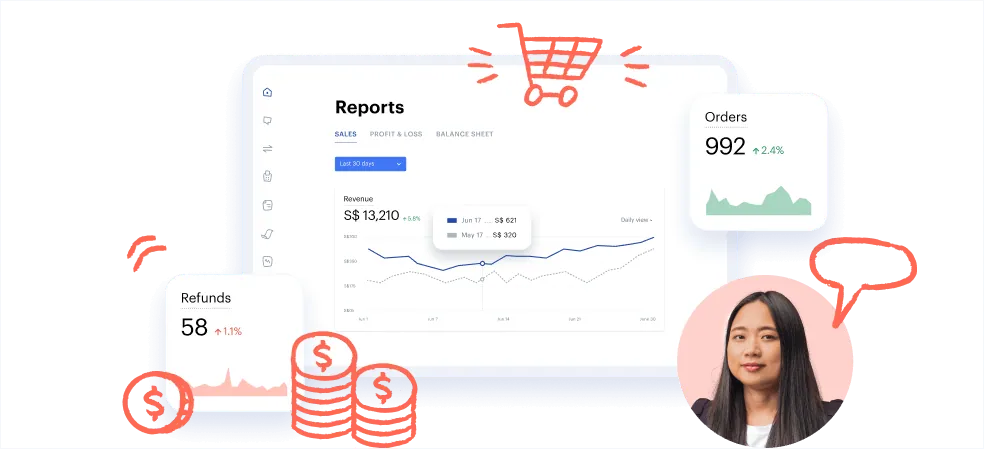

Reporting

Connect your marketplaces and bank accounts to see real-time sales, returns, and fees and make smarter business decisions

Got questions?

Chat with our local experts

Trusted by Oflode

entrepreneurs around the world

What clients say

Beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed. Beatae vitae vitae dicta sunt explicabo emo enim.

Carissa Moore

Beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed. Beatae vitae vitae dicta sunt explicabo emo enim.

Kylie Rogers

Beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit, sed. Beatae vitae vitae dicta sunt explicabo emo enim.

Pam Parker

FAQ

You can create an e-invoice for your business transactions in Singapore. Currently, Singapore is moving away from paper invoices as the government encourages private organisations to use e-invoices rather than manual invoicing.

The government of Singapore implemented a nationwide e-invoicing network in 2019 to help businesses improve efficiency, lower costs, receive payments faster and go green at the same time.

The authorities have made it easier for companies to adopt online invoicing by using e-invoicing solutions on their website www.imda.gov.sg.

To send invoices there are various options available, starting from hiring services to using a software application.

Alternatively, you can use popular tools like Microsoft Word, Excel, or Google Docs for creating simple invoices. With the availability of various business invoicing templates available, you do not have to create one from scratch.

Be sure to include the following information to create your invoices:

- Company name

- Contact information (phone, email, or fax)

- Date of invoice

- Invoice number

Product/Service description

You can also automate your invoicing process, and streamline your financial data by hiring a service provider like Osome to take care of this for you. This way, you can better use your time by focusing on your core business areas.

Some of the most popular payment methods your customers can use are below:

PayPal

PayPal is one of the most accessible and secure payment gateways in the world. The platform has around 400 million active users globally and accepts various debit/credit cards.

Customers also receive seller protection, two-factor authentication, and 24/7 fraud monitoring.

Additionally, PayPal supports 25 currencies and is used in over 200 countries. However, PayPal charges relatively high transaction fees of 3.99 percent, along with a $0.50 fixed fee.

eNETS

eNETS is one of the most reliable payment methods in Singapore. It has relatively competitive transaction fees compared to other service providers.

eNETS is a good option for pairing a payment gateway with merchant accounts. This payment gateway will require a bank account in your business’s name.

In addition, you need to create a merchant account where your customers’ payments will be deposited.

Stripe

Stripe is a relatively new payment method in Singapore. However, it is already well-known for its reliability and flexibility.

Stripe is also ideal for small businesses and startups, which charges a transaction fee of 3.4 per cent on the total selling amount, plus a $0.50 fixed fee.

Hoolah

Hoolah has made the concept of buy now pay later popular in Singapore. Hoolah allows customers to pay one-third of the total cost upfront and the remaining amount through interest-free instalment plans.

Merchants receive the full transaction amount within four days, making this payment method ideal for eCommerce businesses. Customers can pay via debit or credit card.

eWay

eWay is an easy payment gateway that enables easy site integration and accepts various debit and credit cards at a transaction fee of 3.4 per cent on the total sales, along with a $0.40 fixed fee. On top of it, eWay provides 24/7 customer support, which particularly helps new businesses.

The following industries require e-invoices to streamline their business invoicing process in Singapore:

Retail

Small and medium-sized retail businesses can streamline their invoicing system by integrating e-invoicing. It reduces the turnaround time for retail businesses and generates a consistent cash flow.

Manufacturing

E-invoicing can help manufacturing companies in Singapore automate invoicing to lower costs, minimise errors and adhere to regulations. By digitising manual processes, e-invoices help to simplify your financial reporting, for taxes, auditing, and data validation. Using online invoicing, manufacturing companies can also reduce the rate of invoice rejections and accelerate cash flow.

Construction

In the construction industry working with contractors and sub-contractors can often result in payment delays. E-invoicing will help to speed up cash flow and improve the organisation’s ability to begin its next project on time.

High Accuracy

The implementation of e-invoicing reduces the risks of duplication and manual error, whilst ensuring high accuracy because of automated tracking. It is easier to validate invoices, provide approvals, and receive payment in real-time.

Better Visibility

E-invoicing improves the visibility of your invoices, supporting documents, purchase orders, and contracts. All invoicing components including tracking and auditing are available in an e-invoicing application.

Higher Compliance

E-Invoicing enables higher regulatory compliance for businesses, which is mandatory in a country like Singapore.

Reduces Carbon Footprints

By transitioning to e-Invoicing, businesses can eliminate the use of paper-based invoices. Using this environmentally friendly method, companies can increase energy efficiency and reduce their carbon footprint on the environment.